Investor Letter 2025

Magellan Global Opportunities Fund

Dear Investor,

Welcome to the Magellan Global Opportunities Fund. While the fund was initially seeded in early 2022, it has only recently become available to Australian investors. As this is our inaugural investor letter I’d like to share the fund’s genesis, its core investment tenets, and an update on our progress so far.

The idea for this fund was born from a conversation with a longstanding institutional client in the US around four years ago. They expressed a strong appreciation for Magellan’s investment philosophy – our disciplined focus on quality companies, intrinsic value, and long-term thinking. However, they were seeking a portfolio that placed less emphasis on risk mitigation (a key feature of the Magellan Global Fund - Open Class Units) and maintained a fully invested stance. We recognised that this request identified a gap in our offering. As a result, we built a strategy to meet this mandate and simultaneously launched an Australia-domiciled version: the Magellan Global Opportunities Fund.

The fund leverages Magellan’s core DNA but delivers a differentiated risk/return profile. It is expected to have market-type levels of risk over the cycle and is focused on delivering superior returns relative to the MSCI World Net Total Return Index.

For those less familiar with Magellan’s approach, let me reaffirm the investment philosophy that underpins the Fund’s investment performance:

We invest in quality businesses.

We believe the market systematically misprices high-quality companies due to its short-term orientation. Our approach identifies and exploits these opportunities. Our definition of quality is strict and forward-looking. It requires a deep understanding of a company’s competitive advantages; their source, strength and, most importantly, their duration.

Our definition of quality is strict and forward-looking. It requires a deep understanding of a company’s competitive advantages; their source, strength and, most importantly, their duration.

We invest in businesses trading below their intrinsic value.

If you’re not investing based on intrinsic value, you’re a speculator. But making a sensible assessment of intrinsic value is difficult, it’s not based on simplistic metrics. It demands rigorous fundamental research and a long-term perspective. Most market participants don’t focus on a company’s intrinsic value – whether they’re passive investors, retail traders chasing momentum or the latest Wall Street Bets tip, or even professionals focused on short-term earnings results. That creates mispricing.

We are long-term investors.

Quality and intrinsic value play out over time. By tuning out the short-term noise or the current market narrative and instead focusing on where a business will be in three, five, or ten years, we capture what we call duration arbitrage – where quality compounds and price ultimately converges with intrinsic value.

What these tenets have in common is that they take advantage of market mispricing. The market is not efficient. It is overly affected by short-term noise and driven by the news, narratives and investor emotions of the day. And these sources of inefficiencies are enduring. Stocks can become significantly mispriced. This mispricing is identifiable and exploitable, and our process is built to do just that.

A great process is only as good as its execution, and here at Magellan, we have an exceptional investment team. The team views stocks not merely as tickers, but as businesses to be deeply understood. They think in terms of years and decades rather than months and quarters. Their long-term perspective and deep analysis ensure that our investment decisions are well-informed and strategically sound.

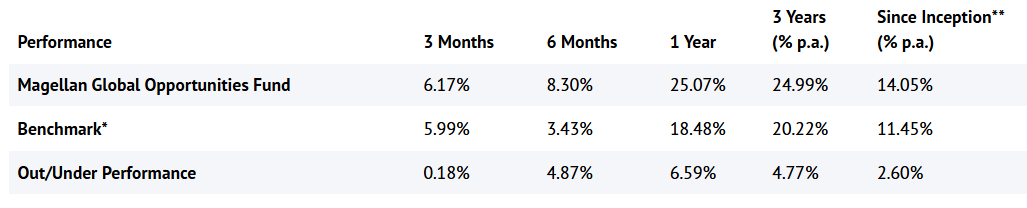

Philosophy, process and execution come together in the Magellan Global Opportunities Fund. Since inception, the fund has delivered 14.05% per annum net of fees, outperforming the benchmark index by 2.6%. Over the past three years the fund has delivered 24.99% per annum net of fees, again beating the benchmark index by 4.77%#.

* MSCI World Net Total Return Index (AUD)

** Inception date 1 January 2022 (Inclusive)

Important Information: Effective 1 July 2024, the management fee was reduced from 1.05% p.a. to 0.75% p.a. and the performance fee changed from ‘12.5% of the excess return of the Fund above the “Absolute Return” hurdle of 10% p.a.’ to ‘10% of the excess return of the Fund above the MSCI World Net Total Return Index (AUD)’. Calculations are based on exit price with distributions reinvested, after ongoing fees and expenses but excluding individual tax, member fees and entry fees (if applicable). Fund Inception 1 January 2022 (inclusive). Past performance is not a reliable indicator of future performance.

And we are just getting started.

With unwavering confidence in our philosophy and team, I believe the fund is well-positioned to continue delivering superior long-term returns. As we navigate the evolving landscape, we remain particularly excited by the long-term opportunities still to come from the adoption of Generative AI technology. Gen AI adoption is in its early stages and continues to have significant potential for innovation and value creation. Many portfolio holdings will benefit from these trends, from those manufacturing AI chips such as TSMC to the hyperscale cloud companies – Amazon’s AWS, Microsoft’s Azure, and Alphabet’s Google Cloud Platform – where demand for computing power will continue to grow robustly over the long term.

Thank you again for your trust: we look forward to keeping you updated on our progress for many years to come.

Alan Pullen,

Portfolio Manager

#as at 30 June 2025